ETH Price Prediction: Navigating Between Technical Support and Institutional Momentum

#ETH

- Technical Support Test - ETH is trading near critical support at $4,400 with Bollinger Bands suggesting potential rebound or further decline

- Institutional Adoption Acceleration - Major partnerships with traditional institutions and corporations provide fundamental support

- Mixed Short-term Signals - While MACD shows improving momentum, price remains below key moving averages requiring cautious optimism

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

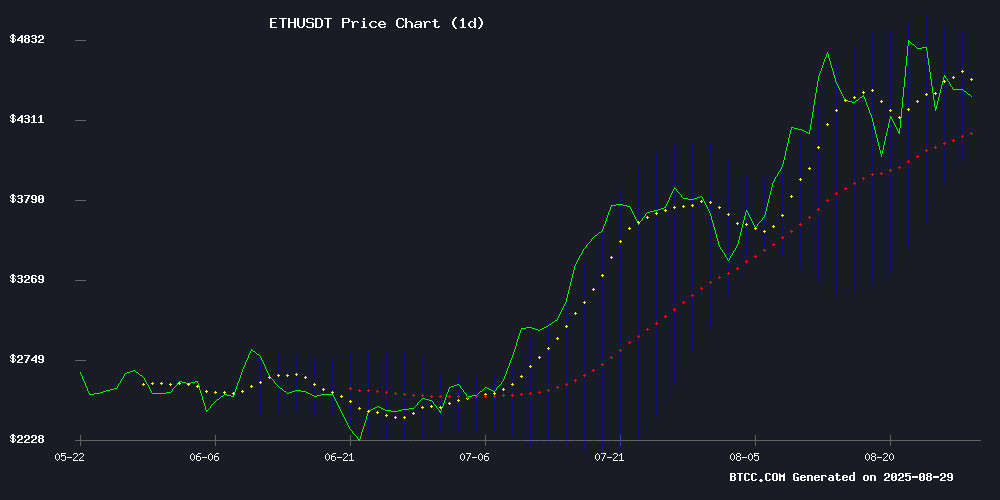

ETH is currently trading at $4,335.44, sitting below its 20-day moving average of $4,468.25, indicating potential short-term bearish pressure. The MACD reading of -54.98 versus -205.09 signal line shows improving momentum despite negative territory. Bollinger Bands position the price NEAR the lower band at $4,058.84, suggesting ETH is testing crucial support levels. According to BTCC financial analyst Emma, 'The current technical setup shows ETH is at a critical juncture. Holding above $4,400 could trigger a rebound toward the middle Bollinger Band around $4,468, while a break below may test the $4,058 support zone.'

Market Sentiment: Institutional Adoption Offsets Short-Term Concerns

Recent news flow presents a balanced yet optimistic outlook for Ethereum. Positive developments including Sony's blockchain venture Soneium, Chainlink's collaboration with the US Department of Commerce, and VanEck's endorsement of ethereum as 'The Wall Street Token' highlight growing institutional adoption. However, headlines about 'bulls losing steam' and potential price breaks below $4,400 introduce near-term caution. BTCC financial analyst Emma notes, 'The fundamental narrative remains strong with record on-chain activity and institutional partnerships, though technical resistance near $4,600 requires monitoring. The combination of real-world utility expansion and traditional finance integration supports medium-term bullish prospects.'

Factors Influencing ETH's Price

Ethereum On-Chain Activity Surges to 2021 Levels Amid Price Rally

Ethereum's on-chain volume resurged in August, matching peak levels last seen during the 2021 bull market. The network processed 46.9 million transactions—surpassing May 2021's record—while weekly liquidity exceeded $14 billion, echoing conditions from crypto's previous summer of euphoria.

Active addresses swelled to 9.7 million monthly users, with daily peaks above 830,000. Despite scaling predictions, the L1 handled DeFi demand without significant congestion, even as ETH price action flirted with the $5,000 psychological barrier.

Whale accumulation intensified during minor pullbacks, including one notable $80.37 million ETH purchase. Stablecoin and DeFi adoption metrics hover NEAR all-time highs, reinforcing Ethereum's dual role as both asset and infrastructure.

Sony's Blockchain Venture Soneium Launches Innovative Scoring System

Sony's blockchain subsidiary Soneium has unveiled a groundbreaking scoring mechanism that redefines user participation metrics in Web3 ecosystems. The Soneium Score employs advanced algorithms to evaluate genuine contributions, moving beyond simplistic token-based reward models that have long dominated the space.

The system meticulously tracks verifiable on-chain activities including asset swaps, staking protocols, and NFT transactions. Liquidity provision across decentralized exchanges also factors into the comprehensive scoring matrix. This approach creates a holistic view of user engagement that transcends mere transaction volume metrics.

Developed by Sony Block Solutions Labs, this ethereum Layer 2 solution addresses two critical Web3 challenges: the absence of standardized user evaluation methods and the difficulty of sustaining long-term community engagement. The scoring model incorporates daily activity consistency, liquidity contributions, NFT portfolio holdings, and partner project synergies.

6 Ways Decentralized Finance Is Challenging Traditional Banking

Decentralized finance (DeFi) is disrupting decades-old banking models by enabling peer-to-peer financial services on blockchain networks. The technology eliminates intermediaries through self-executing smart contracts, offering faster transactions, reduced fees, and greater transparency compared to traditional banking systems.

Where banks profit from transaction fees and slow approval processes, DeFi protocols allow users to lend, borrow, and trade assets directly. This shift could redistribute financial power from institutions to individuals, particularly benefiting those underserved by conventional banking infrastructure.

The movement mirrors broader cryptocurrency adoption trends, with Ethereum remaining the dominant platform for DeFi applications. While regulatory hurdles persist, the sector continues attracting capital and developers at an accelerating pace.

Ethereum Price Prediction and Altcoin Surge Outlook

Ethereum's price trajectory continues to dominate crypto discussions, with analysts projecting a potential rise to $8,000 by 2026. The network's sustained development and growing adoption fuel this optimistic forecast. ETH currently trades at $4,615.44, showing resilience after a 2.43% rebound as buyers defend critical support levels.

Market attention now focuses on Ethereum's ability to breach the $4,650 resistance zone. A successful breakout could propel prices toward $4,800, with $5,000 emerging as the next psychological benchmark. Conversely, failure to maintain support above $4,500 may trigger a retracement to the $4,300-$4,400 range.

While Ethereum maintains its long-term bullish stance, Remittix emerges as a disruptive force in the DeFi payments sector. The altcoin garners attention for its potential 30x surge in 2025, presenting early investors with high-growth prospects alongside Ethereum's steadier ascent.

Chainlink Collaborates with US Department of Commerce to Onboard Macroeconomic Data

Chainlink has partnered with the US Department of Commerce to bring critical macroeconomic data on-chain, leveraging its decentralized oracle network. The collaboration will see key indicators such as Real GDP, PCE Price Index, and Real Final Sales to Private Domestic Purchasers made available across multiple blockchain ecosystems.

The initiative aims to enhance transparency in blockchain markets while enabling innovative use cases, including automated trading strategies and tokenized asset composability. Initial deployment spans ten networks, including Ethereum, Arbitrum, and Avalanche.

VanEck CEO Dubs Ethereum ‘The Wall Street Token’ Amid Institutional Adoption Surge

VanEck CEO Jan van Eck declared Ethereum the de facto "Wall Street token" during a Fox Business interview, as ETH flirts with potential new all-time highs. Institutional adoption is accelerating, particularly for stablecoin transactions—a sector where banks can no longer afford to remain sidelined.

The passage of the GENIUS Act has catalyzed a regulatory thaw, with commercial institutions now integrating stablecoins into financial infrastructure. Ethereum’s smart contract capabilities position it as the backbone for this shift, merging crypto efficiency with traditional finance stability.

Ethereum Holds Steady at $4,600 as MAGAX Presale Gains Momentum

Ethereum maintains its position above $4,600, demonstrating resilience amid global market volatility. The network processes over 1 million daily transactions, solidifying its role as the foundation for DeFi, NFTs, and smart contracts. With billions locked in Ethereum-based protocols, demand for ETH remains robust, reinforcing its long-term value proposition.

Institutional interest grows as Ethereum's $550 billion market cap signals maturity and reduced risk compared to smaller altcoins. Potential ETF approvals could further accelerate adoption. Meanwhile, retail investors eye high-growth opportunities like MAGAX, which merges DeFi mechanics with meme coin appeal, attracting presale participation.

Ethereum Price Bulls Losing Steam – What Happens If $4,400 Breaks?

Ethereum's price trajectory faces mounting pressure as it struggles to reclaim key resistance levels. After a brief recovery from $4,320, ETH failed to sustain momentum above $4,630, with bears now eyeing a decisive break below $4,400.

The 100-hourly SMA and a broken bullish trend line at $4,550 signal weakening bullish conviction. Market participants await either a reversal from current levels or confirmation of further downside, with the 50% Fibonacci retracement level acting as a critical pivot point.

Philippines Explores Blockchain-Based Budgeting System Amid Transparency Push

Philippine Senator Bam Aquino has proposed a groundbreaking bill to place the national budget on a blockchain platform, aiming to revolutionize transparency in public spending. The initiative WOULD make all government transactions publicly viewable on-chain, setting a potential global precedent for fiscal accountability.

"No one is crazy enough to put their transactions on blockchain, where every single step of the way will be logged and transparent to every single citizen. But we want to start," Aquino declared at the Manila Tech Summit. The proposal builds on recent blockchain adoption by the Department of Budget and Management, which implemented a Polygon-based document validation system last month.

If successful, the Philippines could become the first nation to implement blockchain budgeting at scale. The MOVE signals growing institutional recognition of blockchain's potential beyond cryptocurrency applications, particularly in public sector transparency initiatives.

Ethereum Sees Contract Boom In 2025, Setting Stage For $5,000 Rally

Ethereum's new contract activity is surging in 2024 and 2025, mirroring its price ascent beyond $4,500. Historical patterns suggest network activity often precedes price rallies, though the relationship isn't always linear.

The 2020-21 bull run demonstrated how DeFi and NFT adoption could fuel ETH's momentum. Now, with contract creation rebounding sharply, traders are watching for a potential breakthrough past the $5,000 psychological barrier.

Market cycles reveal an evolving dynamic between usage growth and price action. While 2016-17 saw muted contracts during price gains, 2018 proved that adoption alone couldn't sustain valuations during a broader crypto winter.

Ethereum Price Crash, But BlackRock $ETH Bet on 2017 Rally Return

BlackRock, the world's largest asset manager, has made a significant move by purchasing hundreds of millions of dollars worth of Ethereum (ETH) amid a sharp price decline. This bold bet echoes its 2017 strategy, when institutional interest catalyzed a historic rally.

The timing raises questions about market sentiment. While retail investors panic-sell during downturns, institutional players like BlackRock often accumulate positions at discounted prices. Ethereum's recent volatility mirrors patterns seen before major bull runs.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment case with measured risk. The cryptocurrency is testing crucial support at $4,400 while benefiting from significant institutional adoption and real-world utility expansion.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $4,335.44 | Testing key support level |

| 20-Day MA | $4,468.25 | Resistance overhead |

| Bollinger Lower Band | $4,058.84 | Next major support |

| MACD Momentum | Improving | Potential trend reversal signal |

BTCC financial analyst Emma suggests: 'For investors with medium to long-term horizons, current levels offer an attractive entry point given Ethereum's fundamental strength. However, traders should monitor the $4,400 support closely, as a sustained break below could signal further short-term weakness toward $4,058.' The convergence of technical support levels with accelerating institutional adoption creates a favorable risk-reward scenario for strategic investors.